Security Management Program

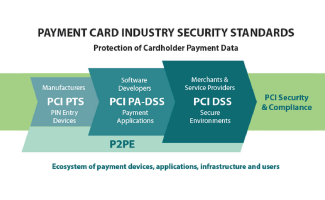

STORIS is committed to ensuring the greatest level of security for our clients and STORIS team members. STORIS renews our annual Datassurant Enterprise Security Management Program (SMP) recognition annually. It is vital to maintain the security standards of our internal organization alongside PCI protocol. Datassurant’s full audit provides compliance validation services to ensure STORIS’ technologies meet the above-referenced requirements for PCI-DSS, PA-DSS, and other major security requirements.

STORIS successfully passed the Enterprise SMP assessment, analysis, and security intelligence services for 2024 consistent with International Organization for Standardization (“ISO”) standard 27002 and the SMP controls related to several areas such as data classification, data handling, data disposal, access rights and privileges, change control, change management, business continuity, disaster recovery, incident response, and security awareness training.

When you choose , you get more than an industry-trusted retail software solution. You get the know-how of our team of experts, superior service, and opportunities for growth. Use the form below to learn what can do for you.

When you choose , you get more than an industry-trusted retail software solution. You get the know-how of our team of experts, superior service, and opportunities for growth. Use the form below to learn what can do for you.