What Is Integrated Accounting for Furniture Retail Software?

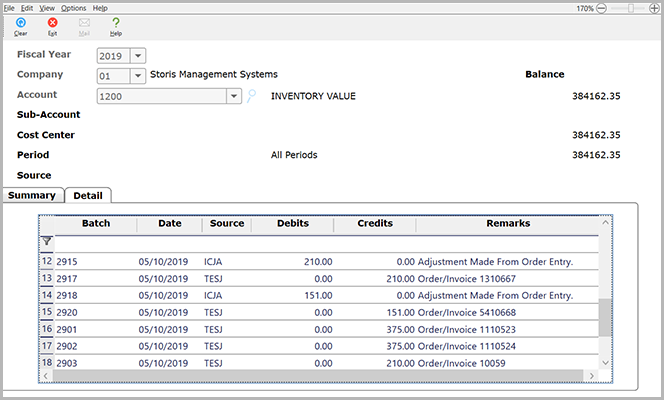

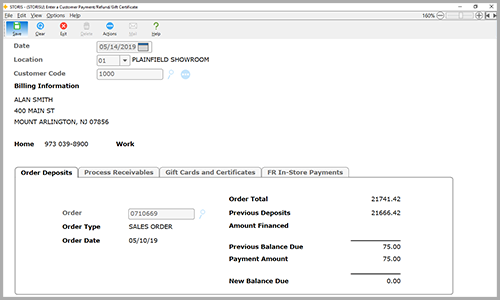

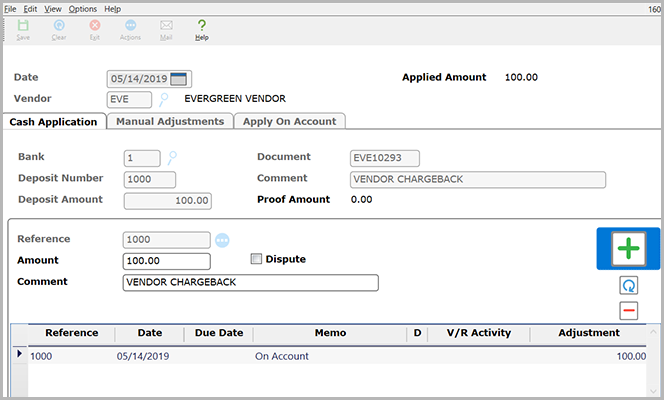

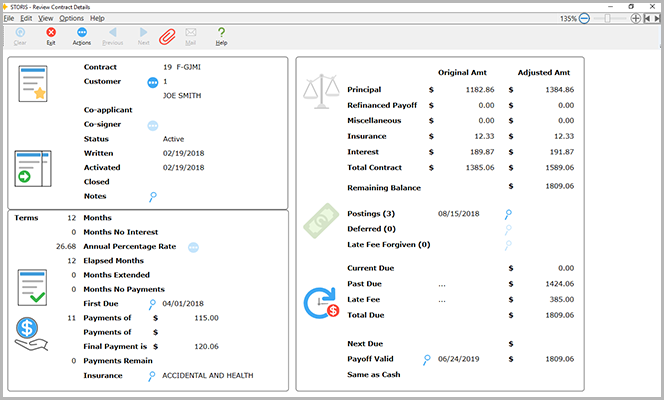

Integrated Accounting Software for furniture retail is a critical advantage in tightening your company’s financials. By automatically tying your Accounts Receivable and Accounts Payable to their appropriate General Ledgers, your accountants have real-time access to the transactional data impacting your company’s bottom line. This provides tremendous benefits of integrating accounting with your transactional POS.

When you choose , you get more than an industry-trusted retail software solution. You get the know-how of our team of experts, superior service, and opportunities for growth. Use the form below to learn what can do for you.

When you choose , you get more than an industry-trusted retail software solution. You get the know-how of our team of experts, superior service, and opportunities for growth. Use the form below to learn what can do for you.