Accelerating Through Innovation

Furniture retailers are writing their next chapter. With the pace of innovation gaining speed, retail is ready for a thrilling next phase. So, buckle up, home furnishings retailers; we’re ready to accelerate.

To accelerate, “the architectural makeup of retail systems must work in harmony across all platforms to accommodate customers. No matter where a customer decides to experience a brand, it should be an experience that doesn’t make them think twice about buying from the same retailer again.”

– NRF

Do you want to know how Top Retailers are accelerating their business growth in 2024?

Retail is positioned for a transformative reinvention of the guest experience. We surveyed home furnishings retailers for insights on strategies to accelerate growth. Acceleration requires critical investments to shift into high gear. Our survey found that 91% of retailers will maintain or accelerate their pace in technology investments in 2024.

The Rise of AI Adoption

A catalyst for acceleration, Artificial Intelligence is the new tool in everyone’s toolbox. AI has propelled the 4th Industry Revolution and will evolve how humans and technology interact.

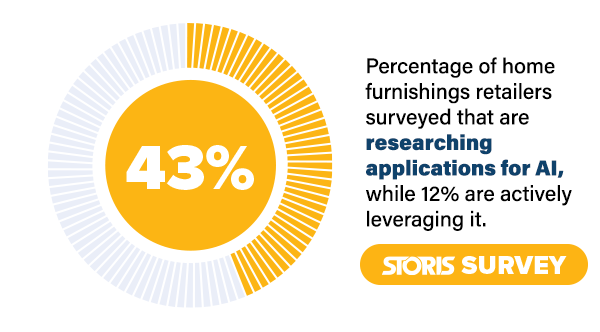

AI is the evolution of computers and machine-based technologies to use critical thinking to understand inputs formerly exclusive to humans. Although not technically new, AI’s widespread accessibility in practical applications like ChatGPT and MidJourney brought artificial intelligence to the masses. While 2023 was the year AI as we know it was born, in 2024 AI usage will accelerate.

“Business leaders are now armed with the greatest technological advancements since the internet: Generative AI, which will be the fulcrum businesses rely on to enhance, empower, and engage employees and customers.” – Forrester

Phases of AI Adoption

Leaders are determining how best to harness AI. Launching AI ahead of the curve can be a competitive advantage. McKinsey found leaders in AI adoption could experience a positive cash flow change of 122% by 2025.

Generative AI

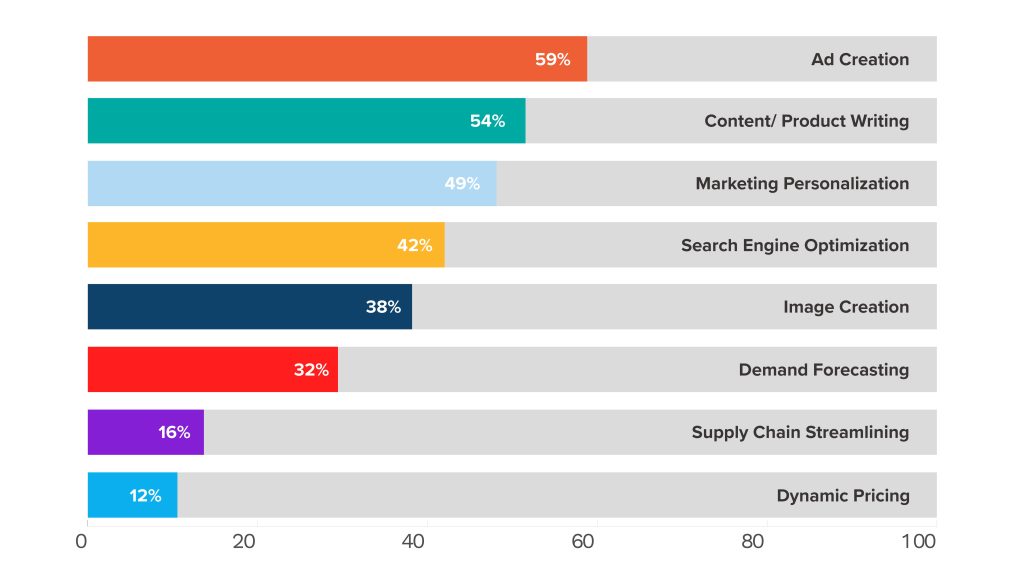

Generative AI has expanded and accelerated our ability to create multimedia content, but it’s potential is unlimited. Removing conventional limitations unlocks the next wave of innovation. Our survey found that furniture retailers are enthusiastic about many applications of AI led by those that will increase marketing efficiency and reduce bottom-line costs.

More than 50% of those surveyed plan or use Generative AI for designing digital ads, writing content, and personalizing marketing.

These frontrunners align with the need for compelling campaigns to entice customers.

How is your business currently leveraging or planning to leverage AI?

The State of the Home Furnishings Industry

With abundant opportunity, let’s explore how market and consumer behavior position retailers for success.

“Retail technology is nothing if not everchanging. Yet the industry continues to adapt and innovate to consistently create a seamless customer experience.” -NRF

An Economic Foundation of Growth

The strength of the U.S. economy is driven by consumer spending and a thriving job market. This was exemplified by the record-breaking $38 billion in sales during Cyber Week, up 7.8% YoY, as reported by Adobe Analytics.

GDP is expected to reach $28 trillion by the end of 2024. The Conference Board anticipates steady GDP growth rates, reduced inflation, and falling interest rates. These positive indicators can support a successful year for home furnishings retail.

Rising Generations Propel Home Furnishings Retail

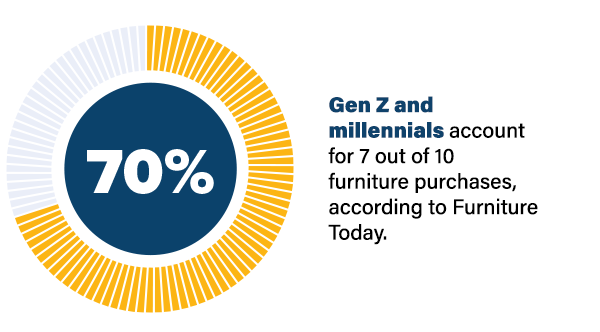

The U.S. Furniture Market is valued at $244 billion by Statista, with a projected five-year CAGR of 3.91%.

Gen Z and millennials have an affinity for technology. To cater to these audiences, STORIS’ survey unsurprisingly found that 33% of retailers see social media as the top opportunity to drive traffic in 2024. Additionally, as in-person shopping is expected to accelerate, furniture retailers can modernize store design to enhance the environment.

The Potential of Promotions

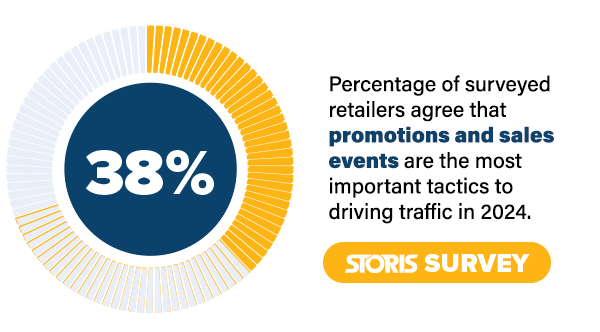

The NRF found deals and promotions were top motivators for a 2% YoY increase in Cyber Week shoppers. A decreasing Consumer Price Index (CPI) rate of 3.2% can also bolster sales in 2024.

Maximizing Showroom Traffic through Community

Retailers seek to connect with their communities and transform their showrooms into sought-after destinations. Partnerships with local brands and influencers through store-within-store concepts or pop-up events can be strategic ways to cross-promote.

Retailers are also offering services within their spaces. Restoration Hardware’s latest DeHaan Estate in Indianapolis exemplifies this. It houses retail, luxury dining, and a wine bar in a historic venue, making it a desirable place for community engagement.

Technology Investments Planned Across Channels

Integrating online and offline channels will be a focal point for 2024, particularly for a seamless transition between digital research and in-store purchases.

Manhattan Retail Associates Unified Commerce Benchmark stated, “Shoppers don’t see ‘channels’ the way retailers do. They simply shop. It’s about amplifying each by fusing the two seamlessly.”

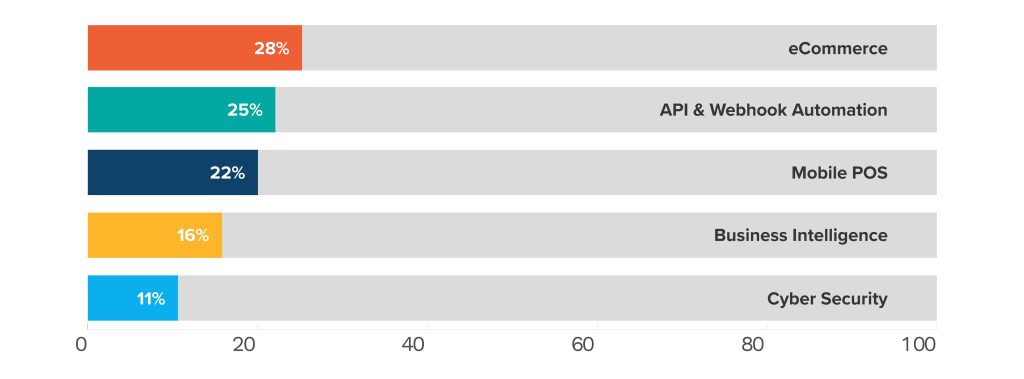

What do you believe should be the top technology focus for retailers in 2024?

Tapping into the Pop-Culture Zeitgeist

In 2023, icons like Taylor Swift, Beyonce, and Barbie highlighted the power of pop culture. Forbes acknowledges pop culture’s impact beyond conventional celebrity endorsements, as unexpected retail surges are triggered in submarkets and licensed products. Upcoming 2024 releases can be capitalized on.

Netflix itself is opening retail locations aligned with its latest shows. In-store events, competitions, and merchandise vignettes that are social-media-worthy or gamified can compel families to visit retail locations, while savvy merchandising can capture impulse sales.

Turning Competition into Collaboration

As companies build tech ecosystems, inspired partnerships form. Take Amazon and Shopify. “Buy with Prime” enables Shopify merchants to use Amazon’s payment and fulfillment services. Amazon’s presence establishes trust for customers looking to purchase from lesser-known websites and increases revenue for all parties. This exemplifies the trend of turning competition into collaboration.

This is seen in home furnishings, with brick-and-mortar retailers developing strategic partnerships with digitally native brands. This amplifies store traffic while tapping into the elusive store networks that direct-to-consumer brands seek, providing revenue acceleration for all parties.

Retail and Technology Initiatives for 2024

The Momentum of Mobile POS

Mobile Point of Sale is a top 3 technology initiative in STORIS’ 2024 survey. Statista projects 94.7 million users of Mobile POS by 2027, with transactions topping $1.28 trillion.

STORIS’ own NextGen Mobile POS surpassed $1B in transactions in 2023.

Furniture Today reported that 71% of in-store shoppers were aggravated by long lines and crowds. Mobile POS eliminates these friction points while expediting checkout anywhere in a showroom. The home furnishings industry is actively embracing Mobile POS to elevate the customer experience.

Selling to Unsold Guests

Mobile POS is critical to facilitating personalized follow-up to unsold guests. 41% of surveyed retailers find the most advantageous use of this data is clienteling, which can be conducted by sales associates to increase their productivity during off-peak hours.

The level of detail captured on unsold guests aids personalization, which is desired by 65% of customers, particularly Millennials and Gen Z. With guests’ product preferences, timelines, and price points, associates can individualize follow-up conversations.

Our survey found that, overall, only 52% of retailers are tracking unsold guests. Top 100 retailers are ahead of the curve at 63%.

Learning Management Systems for Team Expertise

Furniture Today found that 64% of in-store customers were dissatisfied with poorly trained retail teams. This emphasizes the critical role well-trained sales associates play in shaping customer satisfaction, increasing close ratios, and maximizing order values. Upskilling sales teams conveys knowledge and expertise to shoppers.

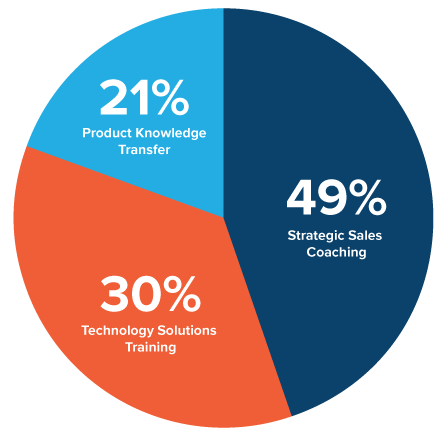

STORIS’ survey revealed that 62% of businesses provide eLearning to employees. The top uses for eLearning are shown in the pie chart to the right:

The Learning Lab found that Learning Management Systems (LMS) reduce training costs while increasing effectiveness. An LMS efficiently diffuses information across a team and enforces retention through gamification. With eLearning, onboarding new employees and upskilling staff is accelerated. The modular design of many LMS platforms can share product training materials from manufacturers.

Customization

Generations growing up with 3D printing and generative AI will become accustomed to instantly creating anything they can imagine. This influences the desire for customizations of furnishings. Customized Furniture Market found the custom furniture market will grow by a compound annual growth rate of 12.21% from 2024 to 2028.

Customization reflects a shift toward customers actively participating in the design process. They desire the individual expression of choosing materials, colors, and styles. The growing prevalence of special orders across industries will increase expectations of fulfillment timeframes. Technology to facilitate accurate customizations, quick vendor communications, and streamlined delivery will be paramount.

Design Services

Design services can be profitable as customers look to modernize and improve the function of their homes. Retail leaders like Arhaus and Ethan Allen are investing in design services and smaller footprint concept stores, increasing revenue per square foot.

Home News Now reported design services “provide average order values of more than four times a standard order.”

The mobility of technology for access to inventory, customizable pieces, and taking orders during home visits or through virtual design services makes this trend easy to facilitate from a technology standpoint.

Automation of Demand Planning

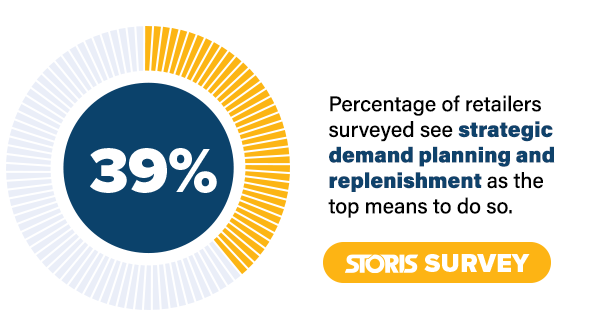

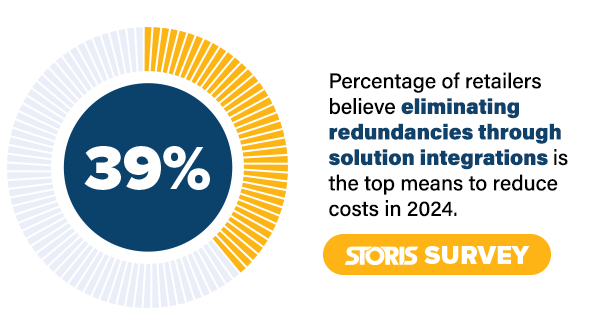

In 2024, retailers can fund strategic investments by cutting unproductive costs.

StartUS Insights noted, “automated forecasting utilizes workflows for better purchasing practices with less cost and time spent.” Improving demand planning improves open-to-buy agility. McKinsey found that using AI for forecasting, rather than relying solely on past outcomes, can improve accuracy by 10% to 20%.

Regionalization and the Last Mile

In 2024, retailers are optimizing internal logistics for swift deliveries. As Business Insider reported, Amazon plans to “double its same-day delivery sites.” These facilities reduce Amazon’s costs by 15%. CEO Andy Jassy emphasizes the benefits of shorter travel distances, cost-effective transportation, faster delivery, and environmental sustainability.

The trend of regionalization is gaining traction, as seen with Ikea’s expansion of fulfillment centers and pick-up locations by 900 units. Retailers are focused on regional distribution centers to align goods with local sales rates and trim last-mile logistics expenses. Retailers can also automate on-hand inventory transfers and alternate stocking locations in their internal supply chain to maximize the efficiency of their owned assets.

AI Shopping Assistants

For eCommerce shoppers, AI-powered online assistants are at the top of their wish list. Customers are burdened by choice and can hesitate to buy until they’ve exhausted their research. AI shopping assistants instill consumer confidence through refined selection based on buying criteria.

Matt Nichols, an NRF Innovation Advisory Committee member from Commerce Ventures, asserts that AI is the catalyst for presenting the right products to the right consumers at the right time, transcending both digital and physical formats.

eCommerce

eCommerce is a driver of revenue acceleration, ranking as the top technology initiative for retailers in our 2024 survey. Enhancing website features reinforces the appeal of online shopping.

Marketing Charts’ study, “Consumer Satisfaction with Online Retail,” highlights attributes of excellent websites, including streamlined checkouts, expanded payment options, and accessible customer support. Incorporating product enhancements like imagery, reviews, recommendations, and varied fulfillment options resonates well with customers. Elevating the checkout experience is especially vital for boosting online conversion rates.

Data Integration via APIs and Webhooks

In 2024, webhooks will be a rising trend, enhancing upon the data automation of APIs. Webhooks trigger actions based on data changes allowing retailers to construct dynamic customer experiences. This innovation eliminates the need for manual intervention, ensuring consistent customer experiences with each trigger occurrence.

Connecting data sources becomes critical as specialized retail solutions are added across technology ecosystems. APIs automate data connections which support comprehensive business intelligence and holistic customer insights. Integration solutions stand out as the primary technology initiative for 25% of surveyed companies, even higher for Top 100s at 44%.

Personalized Digital Advertising

Retailers can instantly create targeted and personalized ad designs with Generative AI. Google Ad’s generative ad builder exemplifies this capability, enabling retailers to effortlessly contextualize product images for different design styles, catering to the diverse preferences of shoppers without incurring additional photography costs.

Membership & Loyalty

Customers are central to brands’ success. Only 30% of furniture retailers surveyed offer a loyalty or membership program. Across retail broadly, 71% offer a program, pinpointing an opportunity for home furnishings.

Price incentives are the most sought-after benefit. Of furniture retailers with programs, 61% incentivize membership with exclusive pricing and promotions, followed by exclusive financing or protection plans at 52%.

Integrating programs into Point of Sale makes managing the program easier for retailers and redeeming incentives seamless for customers.

Consumer Trust & Transparency

Even with emerging technology shaping 2024, our final trend returns to human nature. An Edelman Trust Survey revealed trust is a determinant of success, indicating that “high-trust companies are over 2.5 times more likely to be high-performing.” For customers to share data and open their wallets, they must trust a brand.

This extends beyond merchandise prices to services, fees, and financing. When customers shop with a brand, they allocate a portion of their hard-earned livelihood. Retailers can demonstrate the value placed on this choice by prioritizing transparency, clarity, and consistency in offerings.

Conclusion

As your trusted technology partner, we’re eager to assist our retail partners in reshaping the customer experience. STORIS is actively investing in emerging technologies and the next wave of innovation. We stand ready to accelerate your business through cutting-edge technology that’s dedicated to the success of home furnishings retailers.

Let's Accelerate Together – Take a Tour

Sources:

McLoughlin, B. (2023). Ashley, Bob’s Discount, Overstock CEOs reveal their strategies for leading through disruption. Furniture Today.

(2023). Predictions 2024. Forrester Research, Inc.

(2018). Notes from the AI Frontier Modeling the Impact of AI on the World Economy. McKinsey Global Institute.

Cerami, M. (2023). Retail tech executives on how to remain agile and innovative. NRF.

(2023). Cyber Monday Surges to $12.4 Billion in Online Spending, Breaking E-Commerce Record Retail. Adobe.

(2023). Gross Domestic Product, Third Quarter 2023 (Advance Estimate). Bureau of Economic Analysis

(2023).Economic Forecast for the US Economy. The Conference Board.

(2024).Market Insights – Consumer , Furniture – United States. Statista.

Burnsj. (2023). Understanding today’s furniture shoppers: Insights and opportunities for furniture retailers. Furniture Today.

Friedrick, J (2023). Holiday shopper turnout breaks record over long Thanksgiving weekend. Furniture Today.

(2023). 2023 Unified Commerce Benchmark for Specialty Retail. Incisiv. Manhattan Associates.

Wertz, J. (2023). Pop culture is driving retail sales in more ways than one. Forbes.

(2023). Amazon, Shopify strike deal that gives access to Amazon logistics network. Digital Commerce 360.

(2023). Mobile POS Payments – United States. Statista.

Friedrick, J. (2023). Shoppers are returning to in-store buying, but are they enjoying themselves? Furniture Today.

Friedrick, J. (2023). Consumers share their vision of retail in 2041: Think AI, AR and cashless stores. Furniture Today

(2022). How to Create an Effective E-Learning Strategy for the Retail Industry. Learning Lab.

Russell, T. (2023). Arhaus sets sights on long-term growth. Home News Now.

(2023). Top 10 furniture industry trends in 2024. StartUs Insights.

Chui, M., Henke, N., & Miremadi, M. (2019). Most of AI’s business uses will be in two areas. McKinsey & Company.

Mok, A. (2023). Your Amazon packages will soon come faster — if that’s even possible. Business Insider.

Garland, M. (2023). Amazon’s peak season fulfillment service fee returns Oct. 15. Supply Chain Dive.

Piñon, N. (2023). Ikea to invest over $2.2 billion in new U.S. store models, pickup locations in next three years. CNBC.

(2023). AI and supply chain are top of mind for venture capitalists heading into 2024. NRF.

(2023). Buy now, pay later usage driven by home furnishings and groceries. Adobe Analytics.

(2023). Customized Furniture Market (New Report): Global Research Strategic Analysis 2031. Chemical & Material News via LinkedIn.

Lupis, J. (2023). Customer Satisfaction with Online Retail Rises. Marketing Charts.

Nemes, A. (2023). 7 Strategies for Retail Loyalty Programs to reach Higher KPIs. Antavo.

Hodnett, C. W. (2023). Understanding consumer values is 1st step to trends with staying power. Furniture Today.

When you choose , you get more than an industry-trusted retail software solution. You get the know-how of our team of experts, superior service, and opportunities for growth. Use the form below to learn what can do for you.

When you choose , you get more than an industry-trusted retail software solution. You get the know-how of our team of experts, superior service, and opportunities for growth. Use the form below to learn what can do for you.