Discover 4 Financing Technologies for a Seamless Credit Offering

Click here to access a PDF of The Furniture Financing Guide.

Why Consider Financing for Your Business?

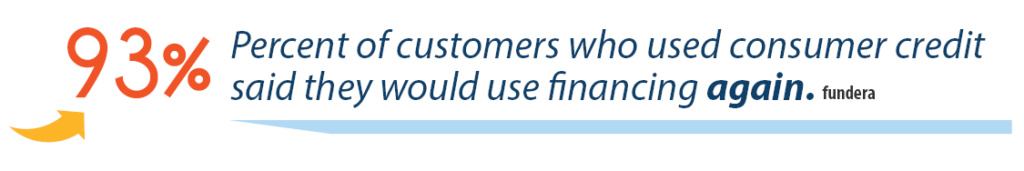

Convert More Buyers with Customer Financing.

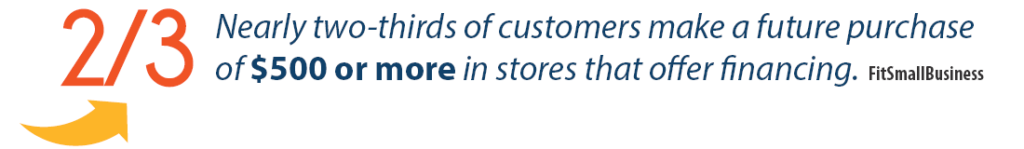

Offering financing options expands the consumer market for retailers and helps more customers furnish their homes in the way they desire. Home furnishings retailers can help make the shopping journey less stressful and more satisfying using technologies for financing. Furniture financing empowers consumers to buy the specific products they want while finding a payment plan that meets their needs.

Innovations in financing processes enable the retailer to offer the consumer a more streamlined application and underwriting experience. This will also simultaneously improve Finance and Accounts Receivables for the retailer with easy payment plan management. Financing plans aim to serve more customers, increase average ticket value, grow customer loyalty, increase sales, and turn more inventory.

Offer Your Customers Financing Today

Request a DemoFill out the form to learn more about STORIS' technologies for in-house and third-party financing.

Request a Demo

Why Customers Value Financing?

Customer Value Financing To:

- Purchase furnishings for a reasonable monthly payment within their desired budget.

- Build positive credit scores by paying off their debts within the specified time frame.

- Easily manage payments that are spread out over a long period.

- Secure a dedicated line of credit for future furniture purchases.

In-House Finance Offerings

Furniture retailers can maintain their own financing programs and hold their own paper. With in-house financing, the retailer acts as a bank, and customers make monthly payments directly to the store. Offering in-house financing is a revenue stream outside the sale of products that the retailer may choose as a core part of their business model. Financing program technologies must comply with the Truth in Lending Act (TILA). Revolving and Installment are two unique financing models that each provide their own benefits around purchase and payment.

Integrated credit applications enable retailers to check customers’ credit scores. Retailers can use credit scoring to decide whether or not to offer and how to structure financing plans. Customers can apply for in-house financing at a retailer’s showroom or online from the comfort of their own homes.

Retailers can set up an Online Bill Pay Portal on their website for the customer to conveniently manage the payments of their revolving or installment accounts. Customers can manage, review, and submit their monthly payments online.

Additionally, integrated Collections allows retailers to monitor debts owed by customers in arrears. Collections agents can help customers get back on schedule by deferring or adjusting payments. Delinquent customers can be tracked based on the age of delinquency to better determine the next steps.

1. Revolving Receivables

Retailers can offer a branded store credit card to consumers with a renewable line of credit monthly. Revolving plans can be set up based on the business’s requirements, such as the Minimum Monthly Payment Amount. Retailers can set up a payment schedule, and interest rate rules for customers with a payment plan managed through Accounts Receivables. Retailers can also require down payments.

Payment plans and promotions can be limited to corporate, franchise, or specific store locations. Offering exclusive promotions and discounts to credit card holders builds brand loyalty and encourages repeat purchasing.

2. Installment

Another way retailers can maintain their own financing is through Installment Financing plans, which is a one-time loan. When a customer is approved for a loan, they make payments towards the original loan’s principal amount as well as a fixed interest rate.

Retailers can set up installment terms, amortization schedules, activation date, grace periods, and expiration dates. Retailers can write their own contracts with specific terms and conditions that may apply. Further, offering the purchase of insurance allows the customer to protect themselves against the risk of their loan.

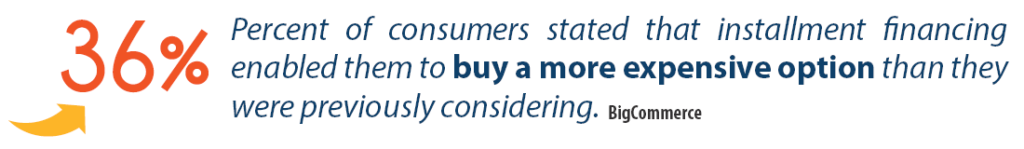

Unlike Revolving, an Installment Contract is a one-time loan agreement for a specific sales order. Consumers who choose installment plans have a better idea of what their total financing costs will be over time, which helps with budgeting. However, installment contracts can be rewritten to enable customers to purchase more under the same loan payment plan.

Integrated Third-Party Financing

Why Partner with Third-Party Financiers?

Providing access to financing is a powerful revenue-generating tool for retailers. Third-party financing partners are a resourceful solution to help consumers pay for the products they want while removing the liability of managing credit from the retailer.

When a customer is approved for financing, they will handle their payment schedule directly with the third-party provider that holds the loan. The retailer receives full payment on the purchased product from the financing provider after the sale is completed minus third-party processing fees. Third party financing is an outsourcing process that is risk-free for retailers and makes the customer’s purchase more affordable.

Why Choose Third-Party Financing?

- Simplified Financial Management– Retailers are paid-in-full from their finance providers after finalizing the transaction on their end.

- Happy Customers– Customers note satisfaction when businesses offer flexible payment arrangements.

- No Risk– If the customer does not pay, there is no added risk to the retailer.

Finance Application Queue

3. Finance Application Queue

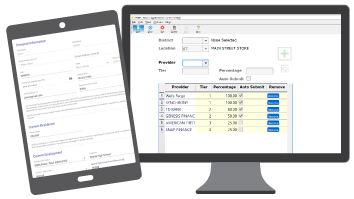

A Finance Application Queue enables retailers to easily provide financing options to their customers. Historically, customers would need to fill out one application per finance provider, which was a long, repetitive process. Today, with integrated technologies, retailers can quickly process multiple requests. Only one application per customer needs to be filled out, and with their consent, can be sent automatically through the queue.

The Finance Application Queue utilizes a list of third-party providers based on a retailer’s established relationships that best fit their business model. Credit applications are submitted to the providers in the order defined by the retailer until the requested amount indicated by the customer is approved.

Technology enables retailers to make all fields required by multiple providers mandatory in one single application. The Finance Application Queue tremendously speeds up the process of securing the customer’s total desired financing amount and helps more customers gain approval with less effort.

Customer Facing Application

4. Customer Facing Application (CFA)

A Customer Facing Application enables customers to seamlessly and securely apply for financing through a self-service application. With security being a top initiative in today’s retail environment, Customer Facing Applications ensure a safe customer experience by minimizing or eliminating the exchange of personal data with a retail associate. Further, two-factor authentication protects the consumer’s identity.

A web-based application can be accessed from any device and is filled out by the customer instead of a sales associate. With only the customer touching their sensitive information, a Customer Facing Application eliminates the uneasiness and discomfort of dictating personal data to a stranger. This gives customers privacy, helps them feel more comfortable about their buying decision, and builds trust with the retailer.

A Customer Facing Application allows consumers to fill out the application in-store through a retailer’s tablet or kiosk. Once customers fill out an application via the Customer Facing Application, they will be shown which providers approved and denied them all from the same screen. Retailers can control IP address access to restrict the use of a Customer Facing Applications to their showrooms.

Retailers can make specific fields mandatory, upload the terms and conditions from each third-party provider, and make text changes and field notes to provide direction to the customer. Additionally, retailers can view all customers that have filled out applications, the status of each, and the amount that is approved or denied.

Discover STORIS Financing Technologies

Offer Customer Financing Today.

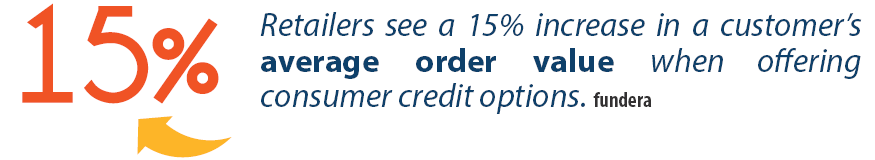

Technologies enable retailers to offer efficient financing options to customers. Streamlined financing can have a tremendous impact on the retail experience, increase revenue potential, and build customer satisfaction. STORIS’ Integrated Financing Solutions include technologies for in-house and third-party financing.

Advantages of STORIS’ Financing Technologies:

- Increased Sales– Give customers more buying power with financing options.

- Grow Average Order Value– Empower customers to complete a larger purchase.

- Gain Loyalty– Build trust between customer and retailer during the credit process.

When you choose , you get more than an industry-trusted retail software solution. You get the know-how of our team of experts, superior service, and opportunities for growth. Use the form below to learn what can do for you.

When you choose , you get more than an industry-trusted retail software solution. You get the know-how of our team of experts, superior service, and opportunities for growth. Use the form below to learn what can do for you.